Automating your money is maybe the most beneficial thing you can do for your personal finances. It removes the need for daily decision making, monitoring, can help keep your spending behaviors in check, reduces stress, the list goes on. All it takes is some front-loaded effort and minimal upkeep and you’ll have your money working with you, not against you.

If you’re reading this, I’m assuming that you’ve already read “Automatic Money—Part 1: The 5 Stage Flow,” a past issue of The Trident. If you haven’t, I highly recommend you do: you can’t build your optimal account structure without knowing what Stage in the Flow you are currently at.

At the end of this, once you’ve set up the account structure that fits your finances best, you’ll have achieved Automatic Money: you won’t need to worry about when the next paycheck or bills hit, if they are going to cause an overdraft, if you’re saving enough for retirement, if you can afford your daily $6 coffee or that $50 sweater, etc. Automatic Money will give you the relief that comes with knowing that your money is working with you, not against you.

Part II: The Structure

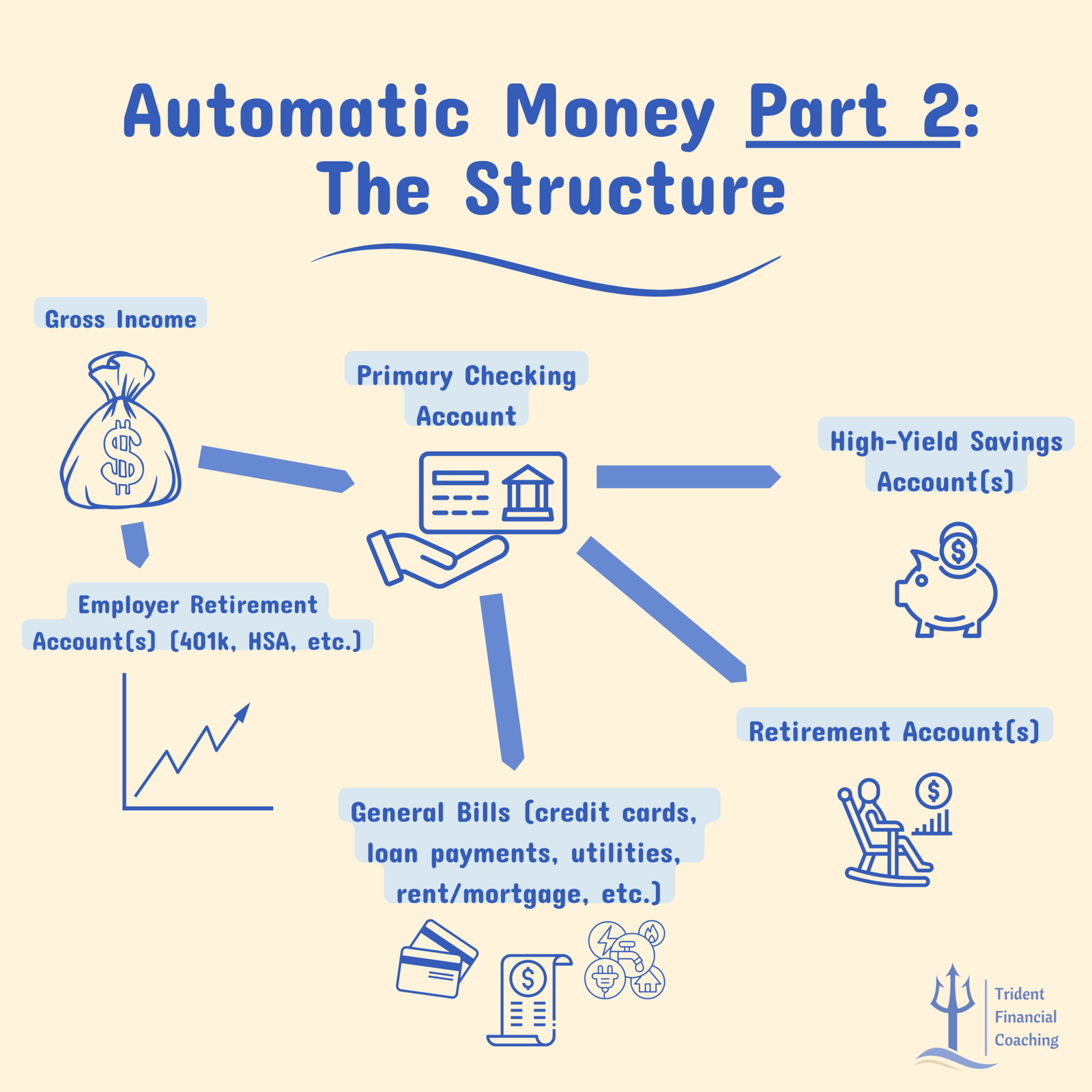

So, what does the Automatic Money structure look like? Well, it’s going to depend on your finances and your preferences, but you should always be fighting for simplicity. The below graphic is a visual for what I would consider the baseline structure:

Starting in the top-left, your gross income (meaning your income before taxes and deductions) gets split up between your employer-sponsored retirement account(s) and your primary checking account. From there, depending on where you’re at in the 5 Stage Flow, set up automatic transfers/payments for the other items:

- High-yield savings account(s) for your emergency fund and other sinking funds for vacation, home and vehicle purchases, or whatever other large purchases you know will be coming up

- Retirement accounts such as a Roth or Traditional IRA or a taxable brokerage account

- General bills, all of which should be set to autopay so you don't ever need to go into a portal to make a payment

Note one of the most important parts of the structure above: everything should be automated; you shouldn’t task yourself with having to know when your water bill is due and manually paying it.

It can be this simple, and simplicity is key. You just need a better understanding of where you’re at financially (what Stage you’re in) and the know-how to build an account structure around your money that automates everything.

I use a very similar structure with a couple tweaks that fit my finances better and have never had an issue wondering whether or not payday would happen before the bill that is supposed to hit on the 31st. No system is without any faults, but an automated system that has some buffer built in is going to be much less faulty than the task you made for your car payment in Google Calendar.

At the end of the day, achieving Automatic Money is the goal: we want our money to be where it needs to be before we can even think to check it. Our money should be working with us, not against us! Understanding where you’re at in the The 5 Stage Flow and creating an account structure around that is how you achieve Automatic Money.

"Is Financial Coaching Right for You?" Questionnaire

Fill out this questionnaire to gauge your understanding of your finances and see if Trident Financial Coaching could benefit you!

Schedule a Free Consultation

Schedule your free consultation here and receive a discount code for a future booking!

Check out the Free Resources!

I've developed various calculators and tools for you to use to help get your financial life in order. Check them out!