All of us have a relationship with money. This is unavoidable because of how integrated it is with our everyday lives. The spectrum of relationships is vast, stretching from avoidance (yes, avoiding it completely is still having a relationship with it) to compulsion, where you are in the weeds at all times.

From what I’ve seen in my experiences, it seems as though all of these relationships can be generalized into three phases:

- My money is working Against me,

- My money is working With me,

- My money is working For me,

Every relationship with money seems to fall into these three phases. Sadly, more often than not, I see people struggling in the “Against me” relationship.

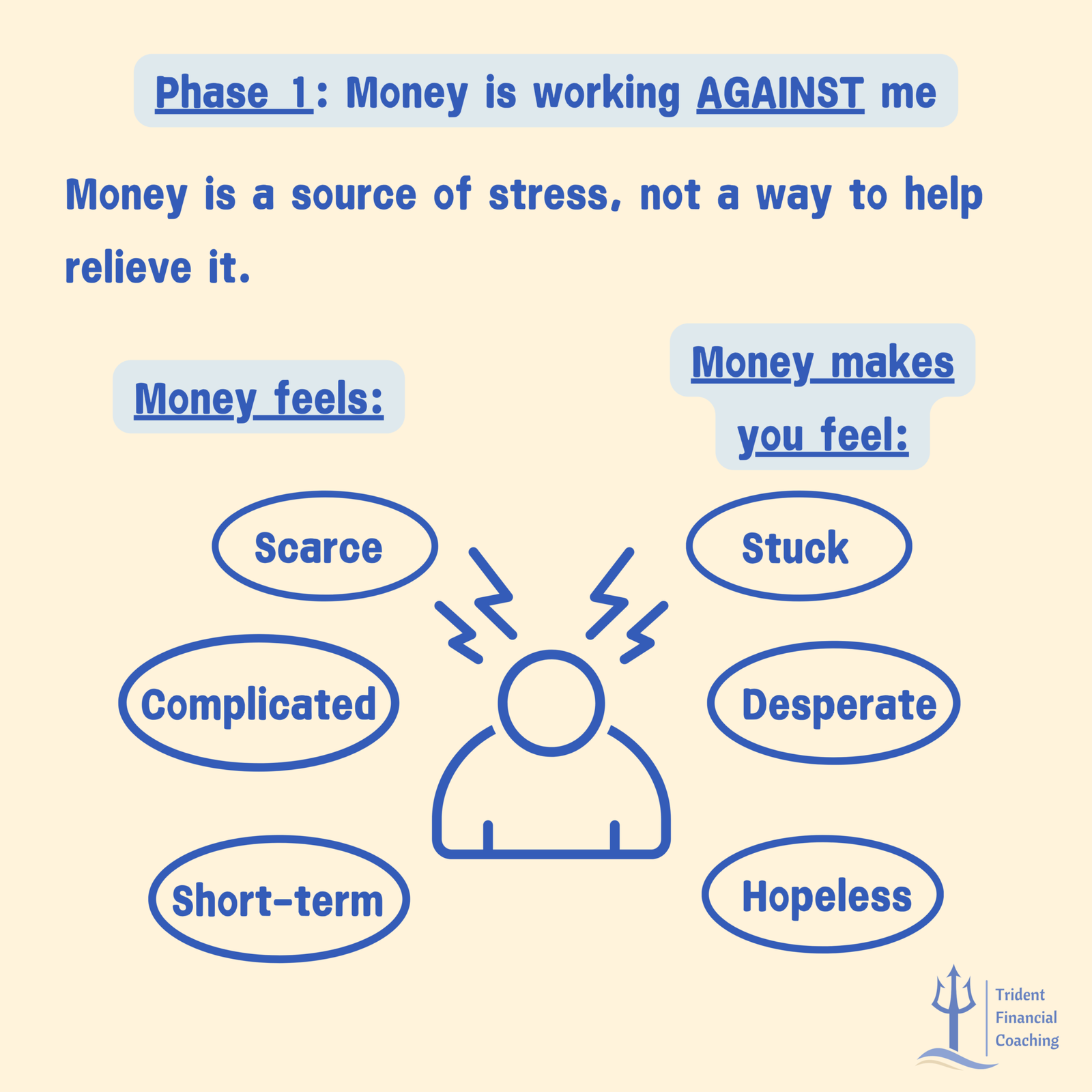

Phase I: My Money is Working Against Me

Your money is working against you when it’s causing you more stress than it’s relieving, or when it causes more friction than it does to smooth out the happenings of life. Yes, money is a tool that can make your life easier or harder, and there is nothing wrong with that truth; whether life becomes easier or harder depends on how you manage it.

This situation probably feels familiar to some extent to all of us because it can look like so many things: thinking about that bill that pulls on the 30th but your paycheck won’t hit until the 31st; the pressure of the decision to loan that money to a friend or family member that is asking for it; the unexpected hospital visit for your sick child that you weren’t financially prepared for; the car that is falling apart in your driveway as you read this with no idea how you’re going to fix or replace it if it couldn’t get you to work tomorrow. The list goes on.

When you don’t manage your money correctly, it will start to feel like it is actively working against you. However, it’s more likely you’ve been working against yourself and the money is just a symptom of poor planning and decision making.

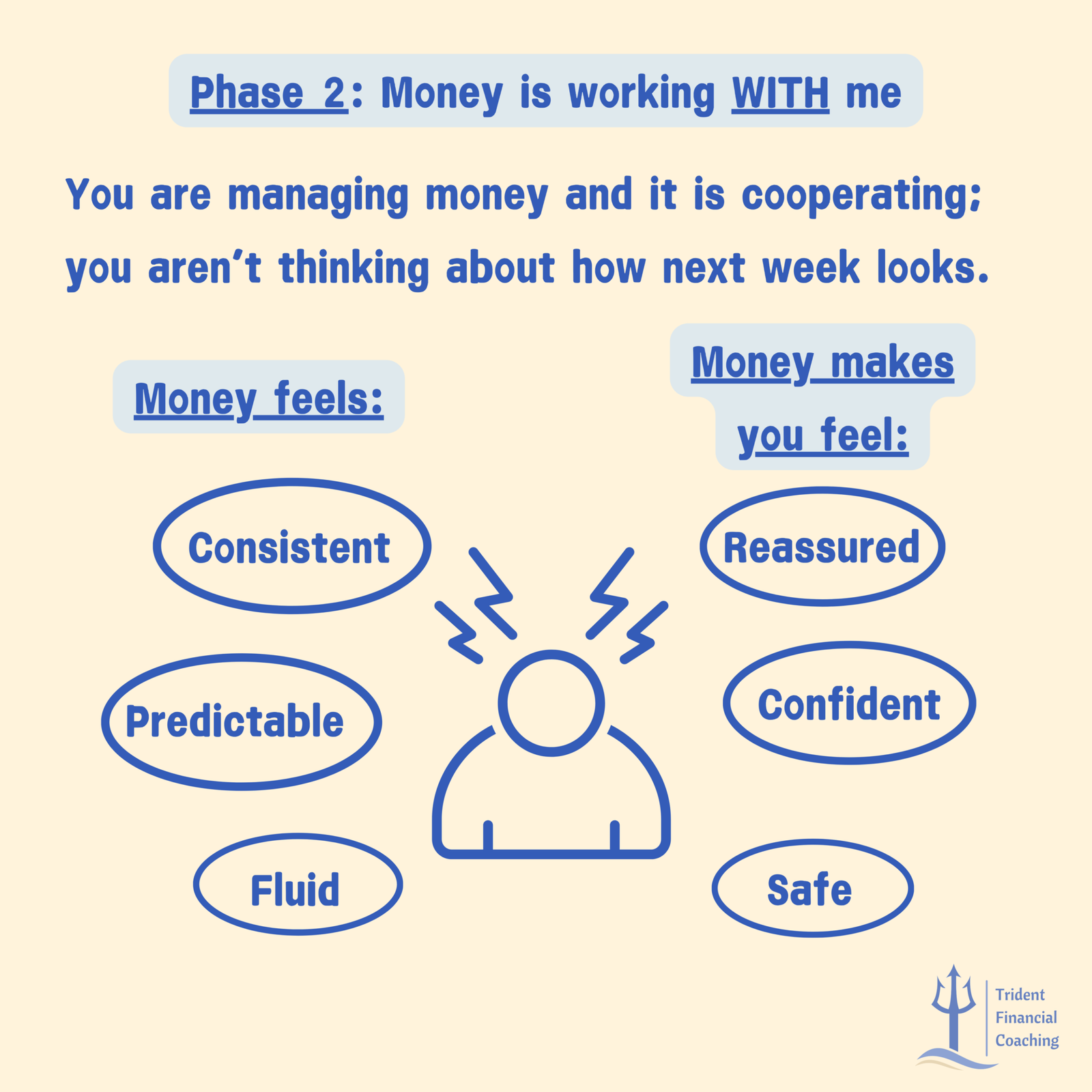

Phase II: My Money is Working With Me

Your money is working with you once you decide that it’s up to you to learn how to manage it. We don’t go simply from money working against us to money working for us; this transitional stage where you are trying to get your money to start helping you rather than hurting you is where you’ll probably learn the most about what you want your future to look like.

You might notice you’re in this phase when you start to think in terms of months and years rather than days and weeks; it doesn’t matter when the next paycheck hits, there’s enough in the account to float you until then. Instead, you’re thinking about how many months it will take to pay off our debts, or how long you think it will be before you can build up that down payment, or how much you want to contribute to retirement, or maybe you’re sketching a savings plan for a car or vacation.

When money is working with you, it’s as though there is productive communication between you and your money for the first time.

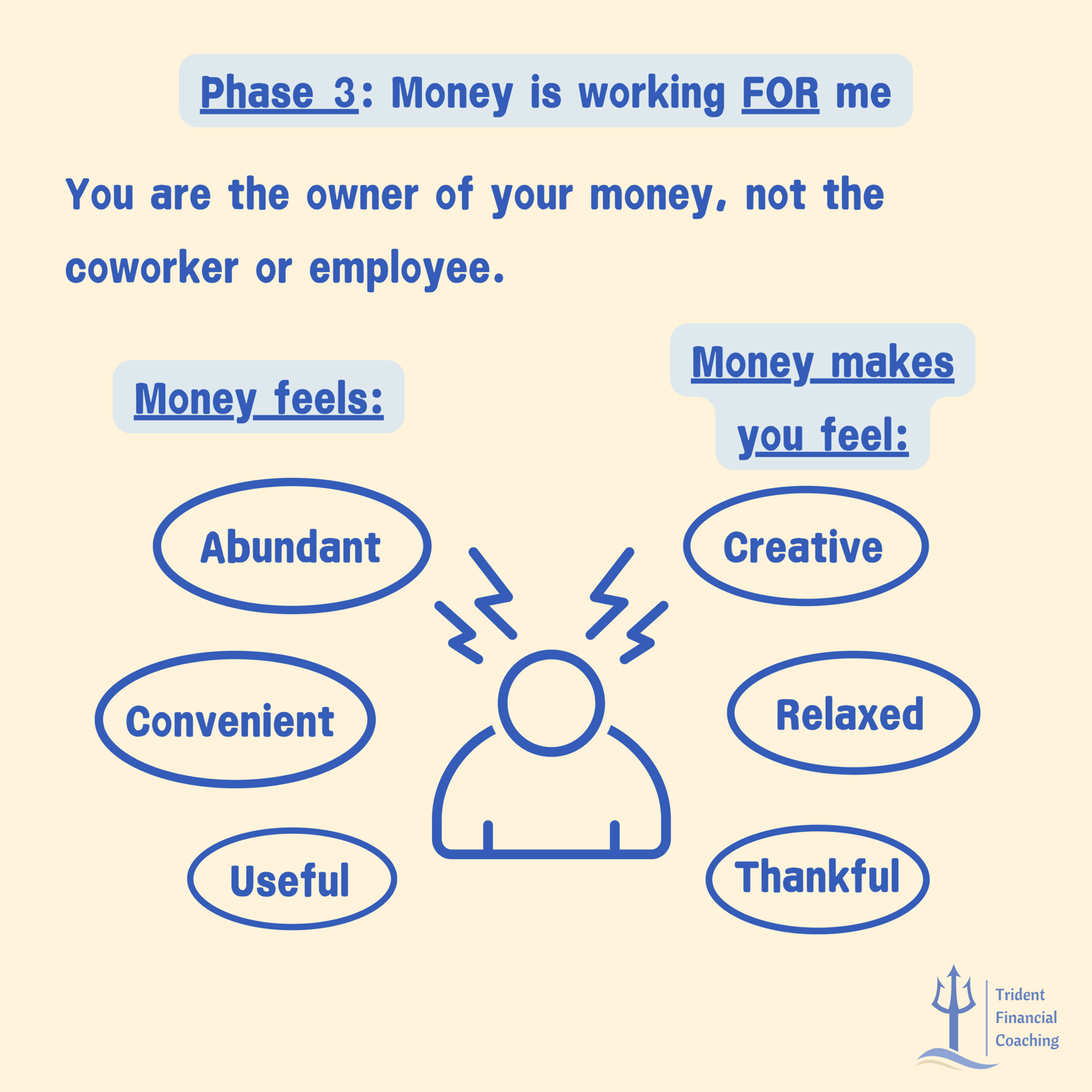

Phase III: My Money is Working For Me

Your money is working for you once you realize that there isn’t much to think about anymore if you don’t want to. You have an automated system that puts your money where it needs to be without constant monitoring, you don’t think about the timing of the little things, and you think more about how you could make your life more meaningful rather than how you can make it to the next paycheck.

Said another way, you are in a place somewhere between avoidance and compulsion that suits you best. Money is now making your life more customizable, convenient, experiential, whatever it is that’s important to you. Money is at your command, and you can hand off the things you don’t want to do and lean into the life you want to live—you are in charge.

We all exist within these three phases. The goal should be to do whatever is in our power to either better our current standing in a phase or move into the next one. We can do that with education, experience, planning, and discipline.

If you want help figuring out how to get from where you are to where you want to be, consider working with me! I too am on this journey and have the experience and knowledge to help you come along with me. Schedule a free 30 minute consultation and take the “Is Financial Coaching Right for You?” questionnaire to see where you stand with your personal finances (both linked below)!

Until next time!

"Is Financial Coaching Right for You?" Questionnaire

Fill out this questionnaire to gauge your understanding of your finances and see if Trident Financial Coaching could benefit you!

Schedule a Free Consultation

Schedule your free consultation here and receive a discount code for a future booking!

Check out the Free Resources!

I've developed various calculators and tools for you to use to help get your financial life in order. Check them out!